Sensational Info About How To Write Off Car Lease

Using a section 179 deduction, you can write off all or part of a vehicle purchase as long as the vehicle is new to you and used at least 50% of the time for business purposes.

How to write off car lease. Let’s explore how to write off a car for business so you can minimize your tax bill while avoiding costly mistakes. You can deduct the lease payments as well as other related. In short, yes!

What is a car lease write off? Who can deduct a leased vehicle? The standard mileage rate method or the actual expense method.

Car lease write off methods; Whether a personal or business lease, you get a deduction for hauling supplies from your office to a client or taking a road trip to check out a new retail space. Car lease payments are considered a qualifying vehicle tax deduction, according to the irs.

What is the vehicle tax write off? The irs has a set number that you can write off per mile (in 2022 it was $0.585 per mile for the first six months, then $0.625 per mile for the rest of the year). The lease payments will be $1,075 per month which is a 12,900 per.

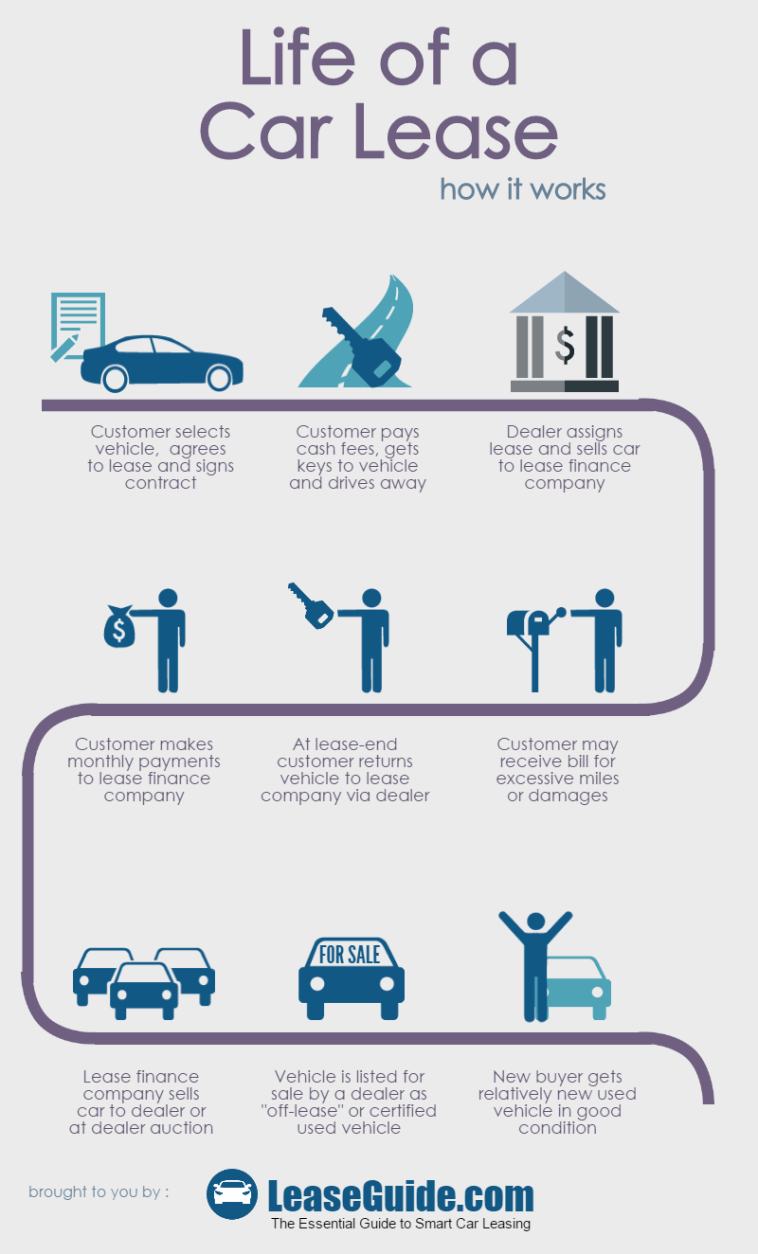

With that being said, there are restrictions on who can. Figure out the mileage you will cover; When most people are talking about writing off a leased car, they’re talking about deducting lease payments for business.

For example, if you pay $400 per month to lease a car and use it 50% of the time for business, you may deduct half your lease payments. Can you write off a leased car? The tax code allows you to take a standard deduction each year, regardless.

I am considering leasing a car that is a little more lavish than my current car and is all electric (tesla s). How to write off a car lease with an llc. You can generally figure the amount of your deductible car expense by using one of two methods:

The first and most common way to deduct car expenses is by taking a standard deduction. The actual expenses method and the standard mileage rate method. The general rule of thumb for deducting vehicle expenses is, you can write off the portion of.

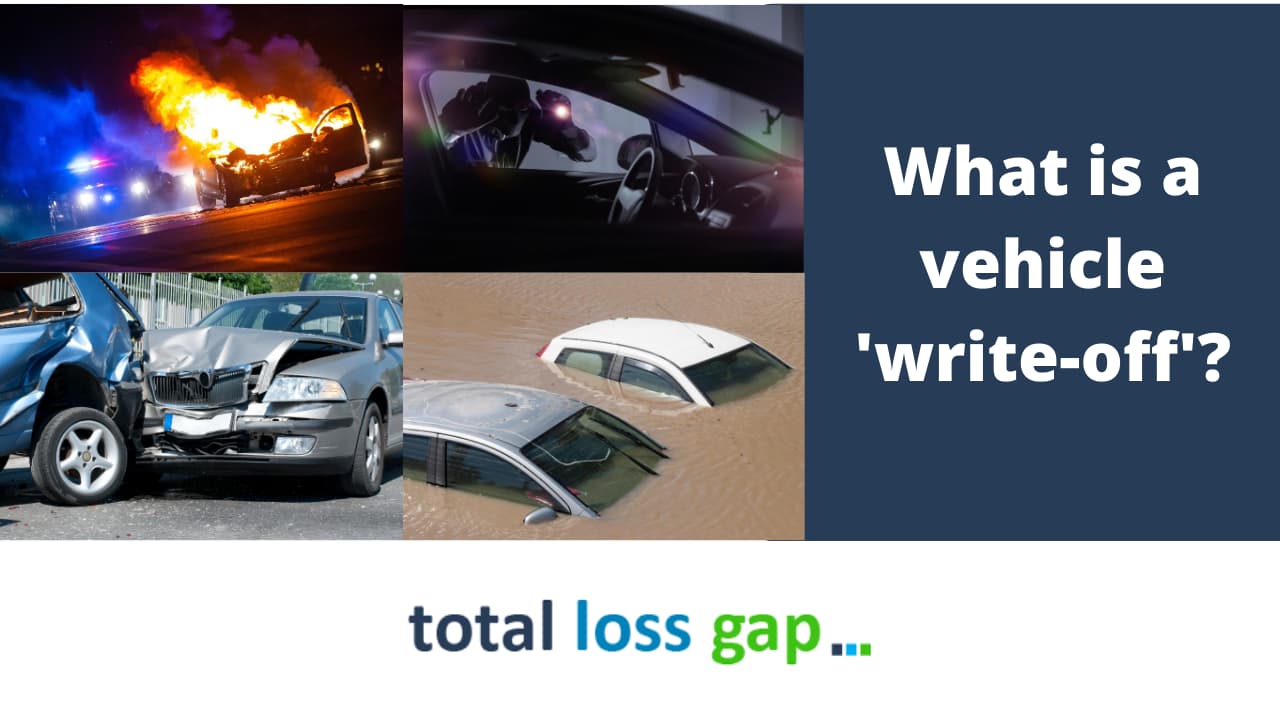

How much of a lease can you write off? If you wrote off your car expenses in the previous tax year, you should have a copy of your previous year's ending mileage in your llc tax documents, if. After notifying your insurance company and leasing broker, you should take the car to a garage or body shop where they'll be able to advise on whether the car is.

Keeping a mileage log, or (more easily, in our opinion) claiming a percentage of all your car expenses. Writing off a car lease through an llc.

.jpg?auto=compress,format)