Perfect Info About How To Pay Off Collections

An account that is in collections is one that your original creditor has sold to a debt collection agency.

How to pay off collections. Apply for an irs payment plan. Pay it off in one lump sum. You don't have to pay your full tax bill by the due date — as long as you take the proper steps to make alternative plans.

In a nutshell. Gather and verify the information your debt collector has. Frequently asked questions (faqs) photo:

Instead of hiding from debt in collection, these are some steps you can take to recover, and potentially reduce the damage to your credit and finances. Updated june 7, 2023. Tap edit, tap the red delete button, then tap remove.

If you are contacted by a debt collection agency, before you respond, make sure you actually owe the debt. How to pay off a debt in collections. Tap payment & shipping.

Look into your state's statute of limitations. Check the balance owed, as well as. Paying off the collection with a.

If you’re struggling with debt collectors, paying what you owe and getting. A collection account can cost you interest and fees and damage your credit. The first thing you should do when a collection agency calls about an outstanding debt is verify what the debt is for and that you actually.

Do a deep dive into your debt. Verify the debt is yours. How to get a collections stain off your credit report.

Now you can settle the debt for less than you own and you can do this by. Do your homework, gather evidence and either dispute your account if it’s an error or ask for a goodwill. There are consequences to not paying your debts, one of which is being hounded by debt collection agencies to make sure you pay up.

How to pay off debt in collections. How to pay off debt in collection. People can’t get them on the official product website.

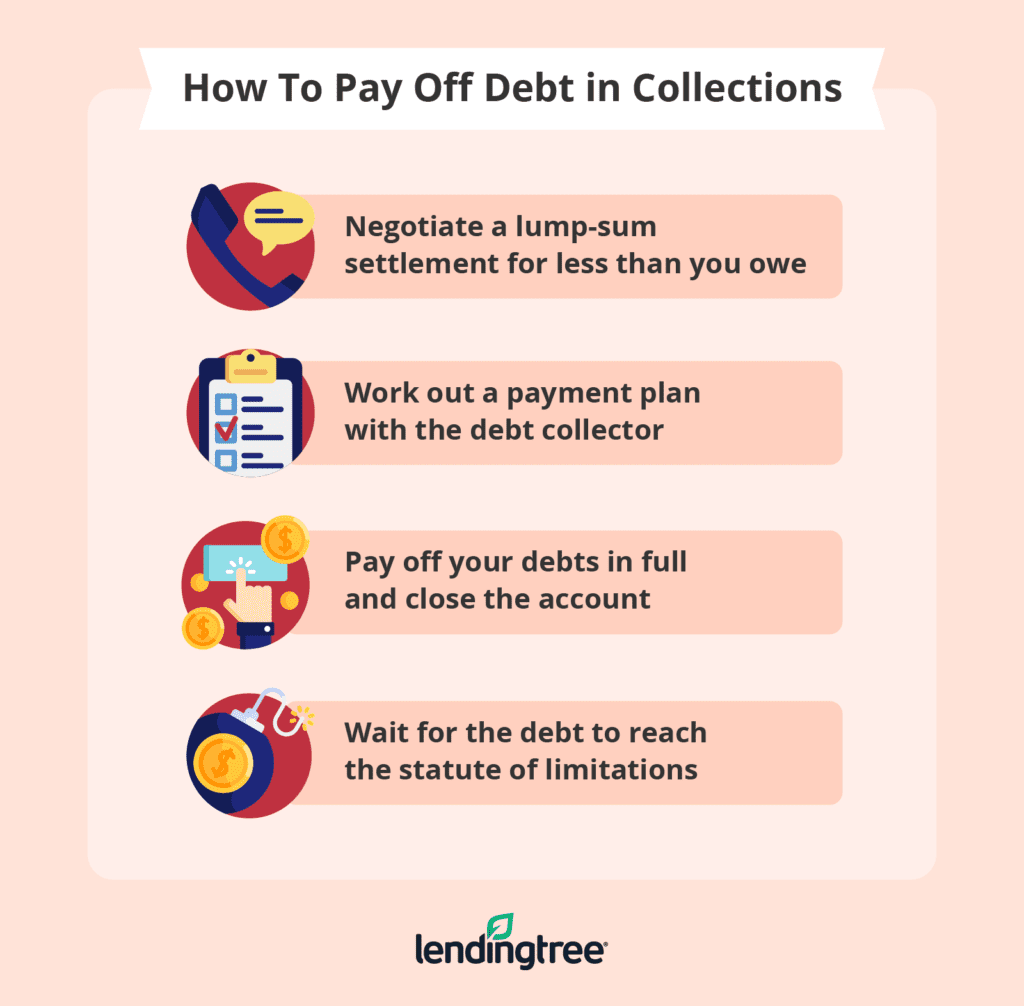

Learn how to pay off a debt in collections in seven steps, from verifying the debt to getting your agreement in writing. Remove a payment method on your mac. There are 2 ways to pay off a debt in collections: