Lessons I Learned From Tips About How To Claim Medical Expenses Canada

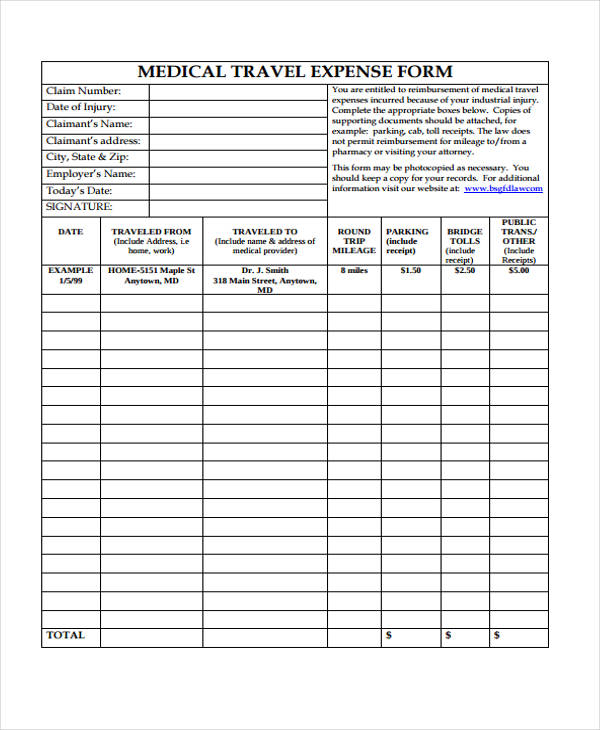

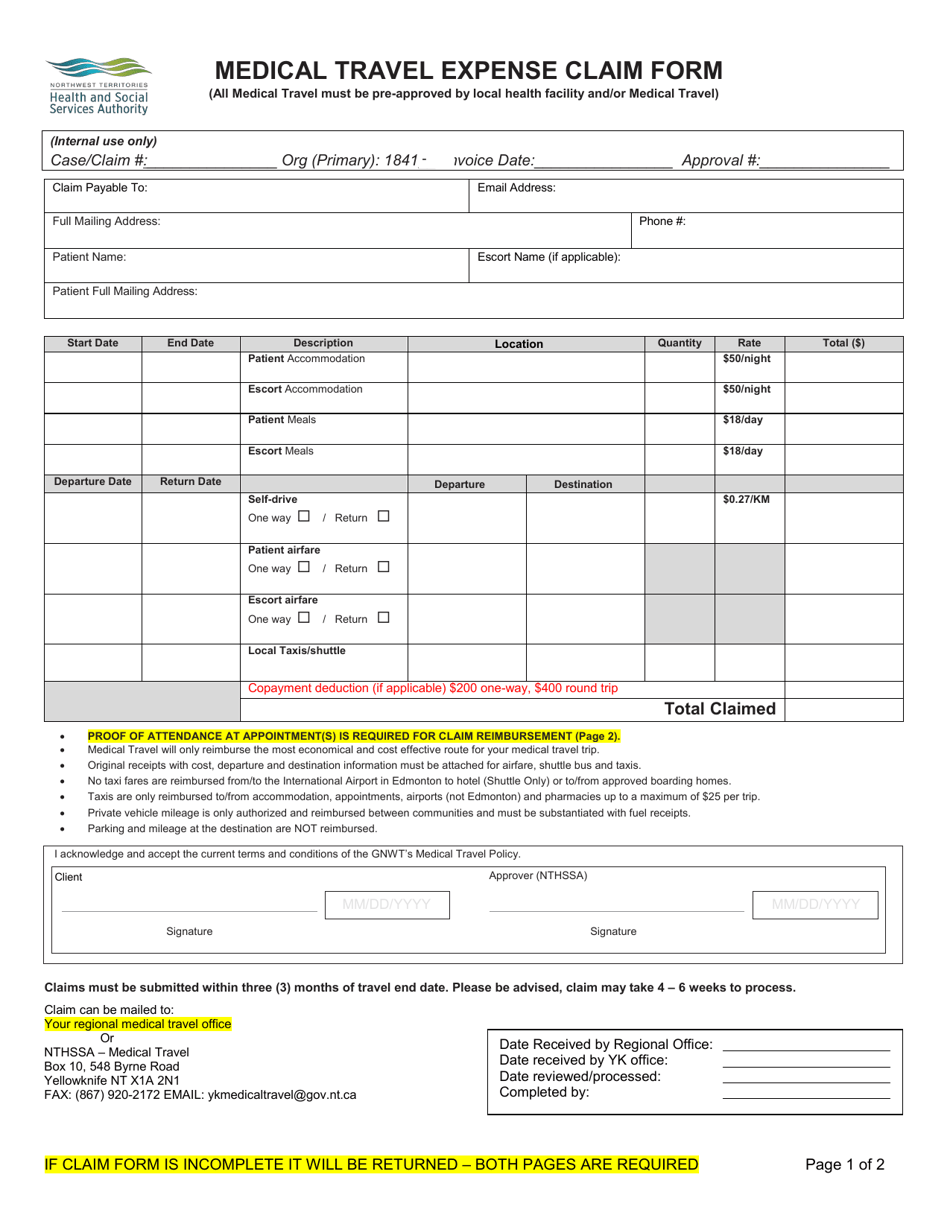

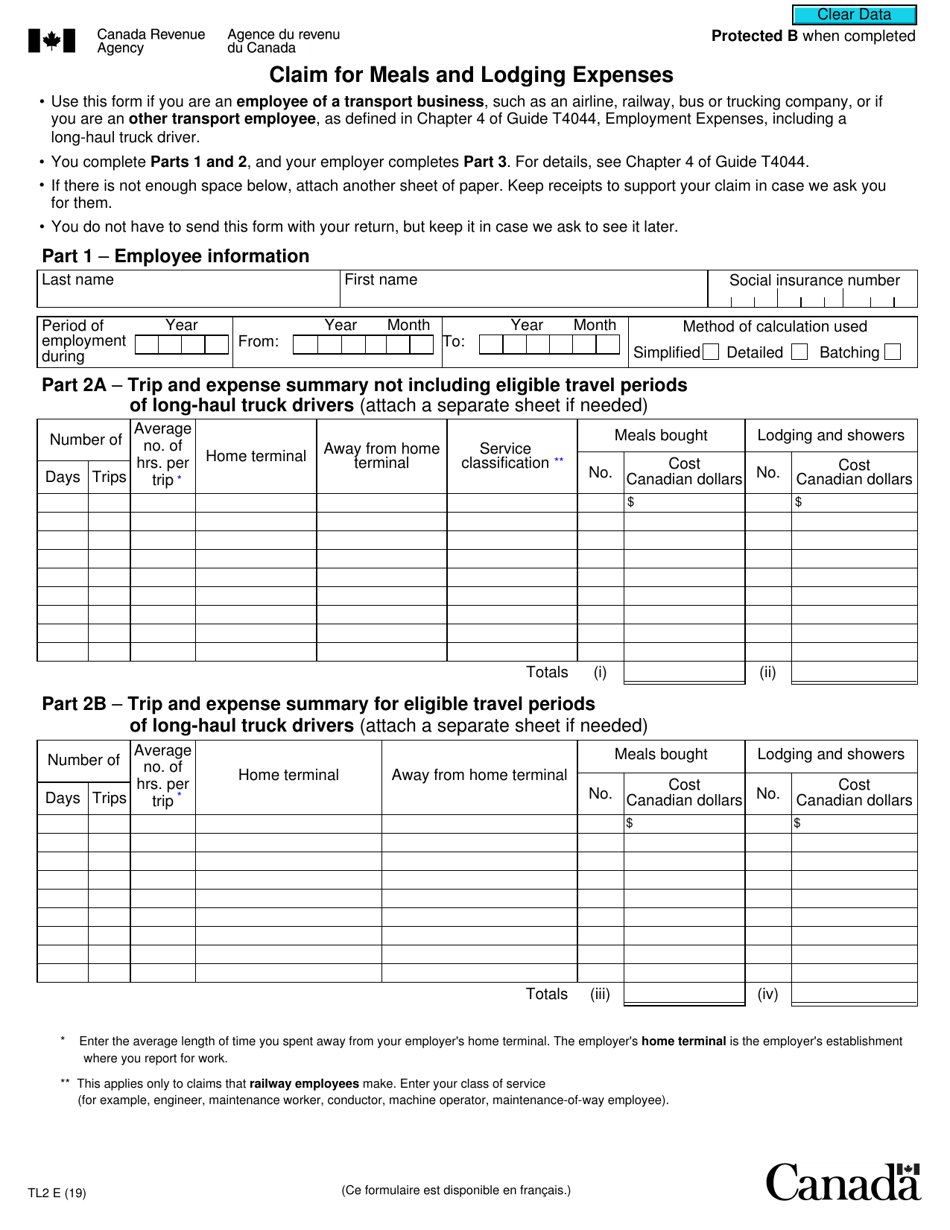

Bus, train, or taxi fare).

How to claim medical expenses canada. The maximum amount of medical expenses for tax deduction in canada is either 3% of your net income or $2,479, whichever is lower. If you traveled at least 40 km (one way) to get medical services, you can claim the cost of public transportation (ex. You can claim eligible medical expenses on your return if the expenses were:

Keep those prescriptions and receipts handy, as they’re. Medical expense claims should be included in an individual taxpayer’s personal income tax return. Income tax act s.

For starters, you can claim amounts spent by you, or your spouse or. Medical expense claims are made using line 330 or 331 on schedule 1 of your tax return. 118.2 (1) who can claim medical expenses?

For example, if you itemize, your agi is $100,000. You can also claim medical expenses for your. Filing medical expenses claims.

To claim your medical expenses, follow these steps: To be eligible, expenses must exceed a limit of 3% of your net income, subject to a. For example, if 3% of your net income is.

If your eligible medical expenses exceed the threshold, the medical expense tax credit (metc) allows you to claim medical expenses paid for yourself,. For your 2022 return, the medical expense tax credit (metc) is available provided your family’s total medical expenses exceed a minimum threshold equal to the. Five medical expenses you can deduct on your taxes.

Claim expenses for dependants: