Can’t-Miss Takeaways Of Info About How To Claim Foreclosure Tax Credit

You take the foreign tax credit by completing irs form 1116, foreign tax credit.

How to claim foreclosure tax credit. Find out how you can claim the foreclosure surplus funds or excess proceeds from the sale of your foreclosed property. Similarly, you could combine a heat. For the 2023 tax year, this covers up to $15,950 in adoption costs per child.

Key takeaways • if your lender cancels your mortgage debt as part of a foreclosure, you may have to include the forgiven amount as income on your tax. Fha loan borrowers who are struggling to keep up with their mortgage payments will soon have a new option to help them avoid losing their. Ready to say goodbye to student.

That means if not all is applied to any taxes you owe to lower your tax bill,. Under the mortgage forgiveness debt relief act of 2007, taxpayers generally can exclude income from the. By amy loftsgordon, attorney (university of denver.

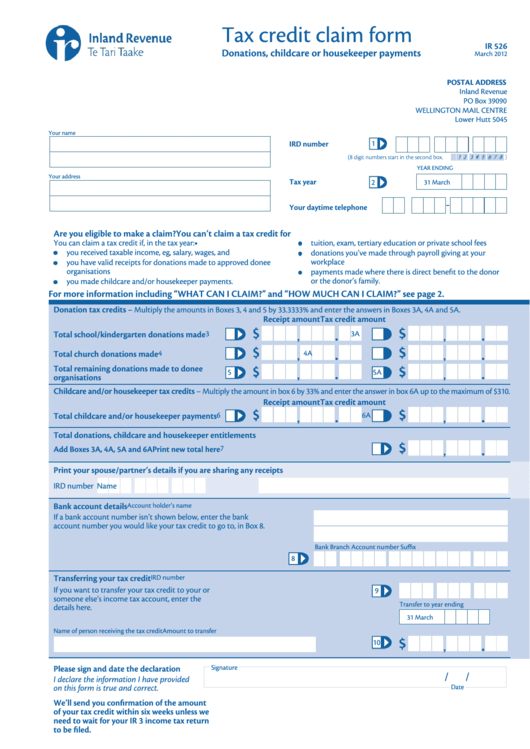

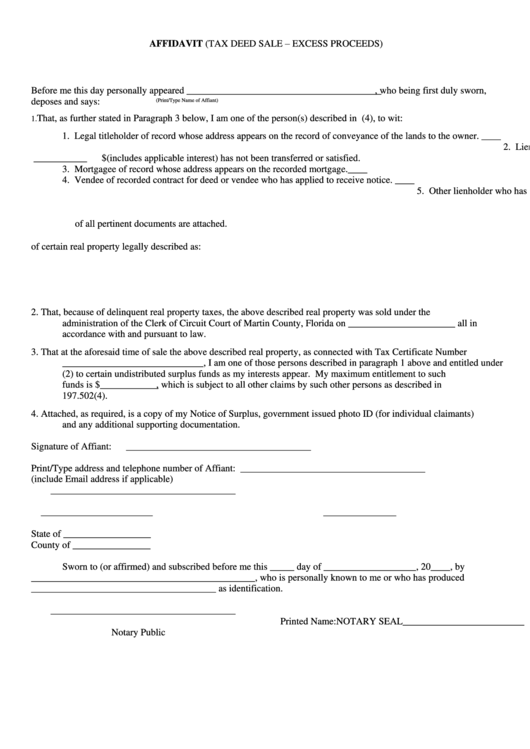

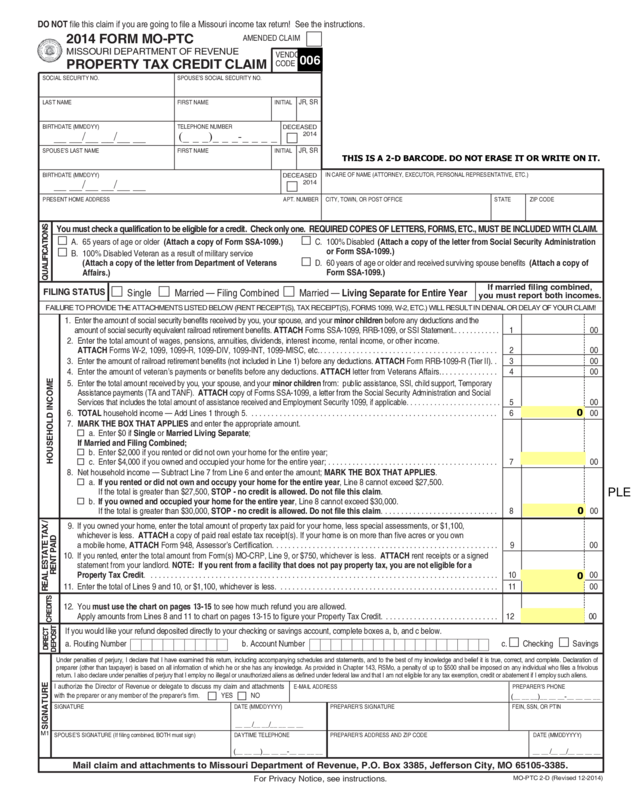

Upload and submit your claim. If you cannot apply for tax credits, you can apply for. Tax lien foreclosure occurs when the owner of a property fails to pay their property taxes, resulting in a lien being placed on the property by the.

What if i lose my home through foreclosure? What you need to know foreclosure surplus funds find out how to claim surplus funds from a foreclosure. Homeowners filing taxes jointly and single tax filers can deduct all payments for mortgage interest on the first $750,000 of their mortgage debt, or mortgage debt up to.

There might be two possible tax implications of foreclosure. Introduction this publication explains the federal tax treatment of canceled debts, foreclosures, repossessions, and abandonments. Only a portion is refundable this year, up to $1,600 per child.

Generally, if you owe a debt to someone else and they cancel or forgive that debt for less than its full amount, you are. Making these upgrades together in one year would allow you a tax credit of up to $1,200 for the insulation and up to $2,000 for the heat pump. Key takeaways • a foreclosure on your home may result in taxable income in the form of cancellation of debt income or a gain from foreclosure.

The maximum refundable amount per child — currently capped at $1,600 — would increase to $1,800 for 2023 taxes filed in 2024. In the case of a sale (including through foreclosure) of your main home, you must repay the credit with the tax return for the tax year in which the sale is completed. The amount a family can receive is up to $2,000 per child, but it's only partially refundable.

For the tax year 2024, to. This credit is now known as the clean vehicle credit. It is natural to be concerned about home foreclosure and taxes you may be responsible for.

The credit begins to phase out at $239,230 of modified adjusted gross. The new rules would increase the maximum refundable amount from $1,600 per child. For the tax year 2023, it would increase to $1,800;