Spectacular Tips About How To Be Hedge Fund Manager

What is a hedge fund manager?

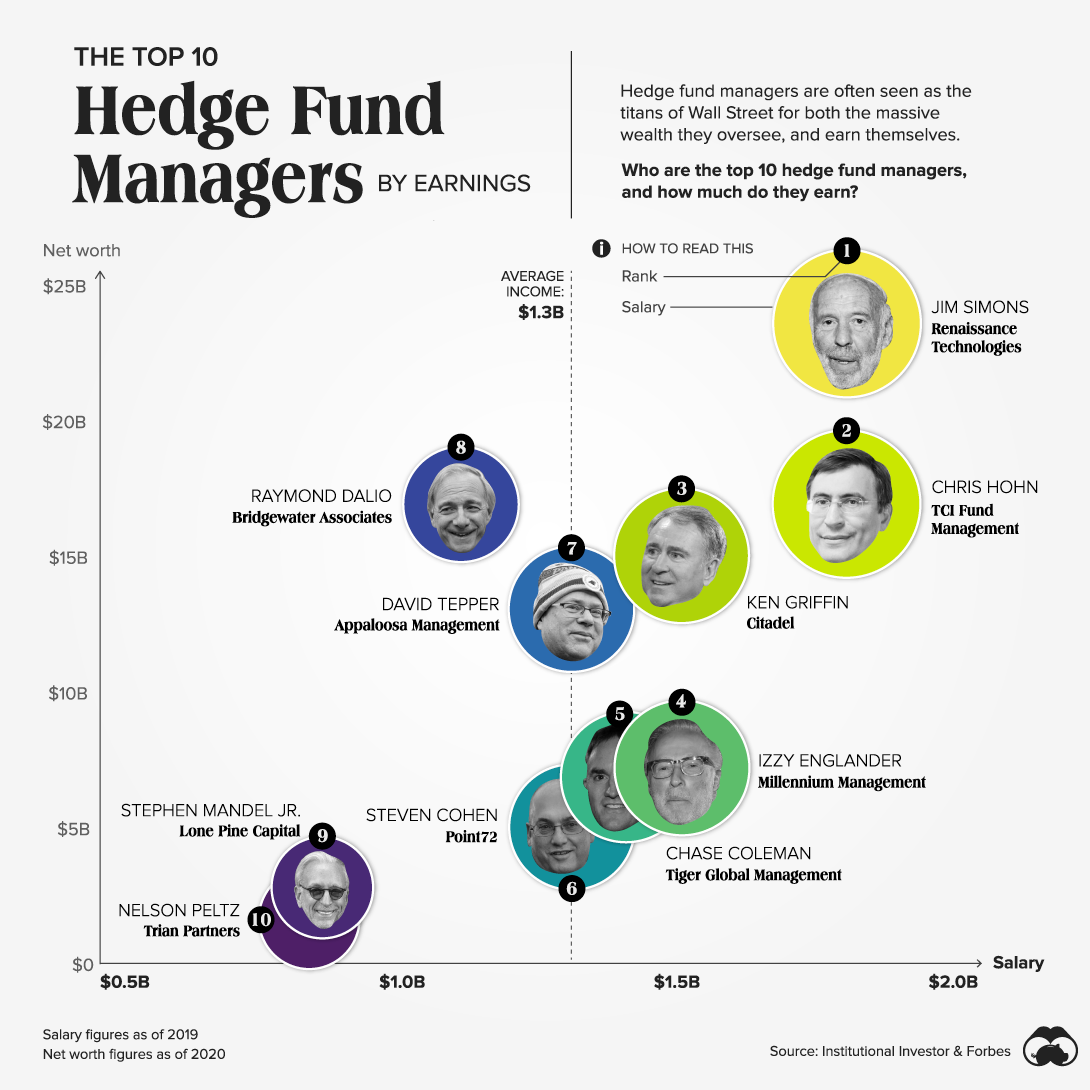

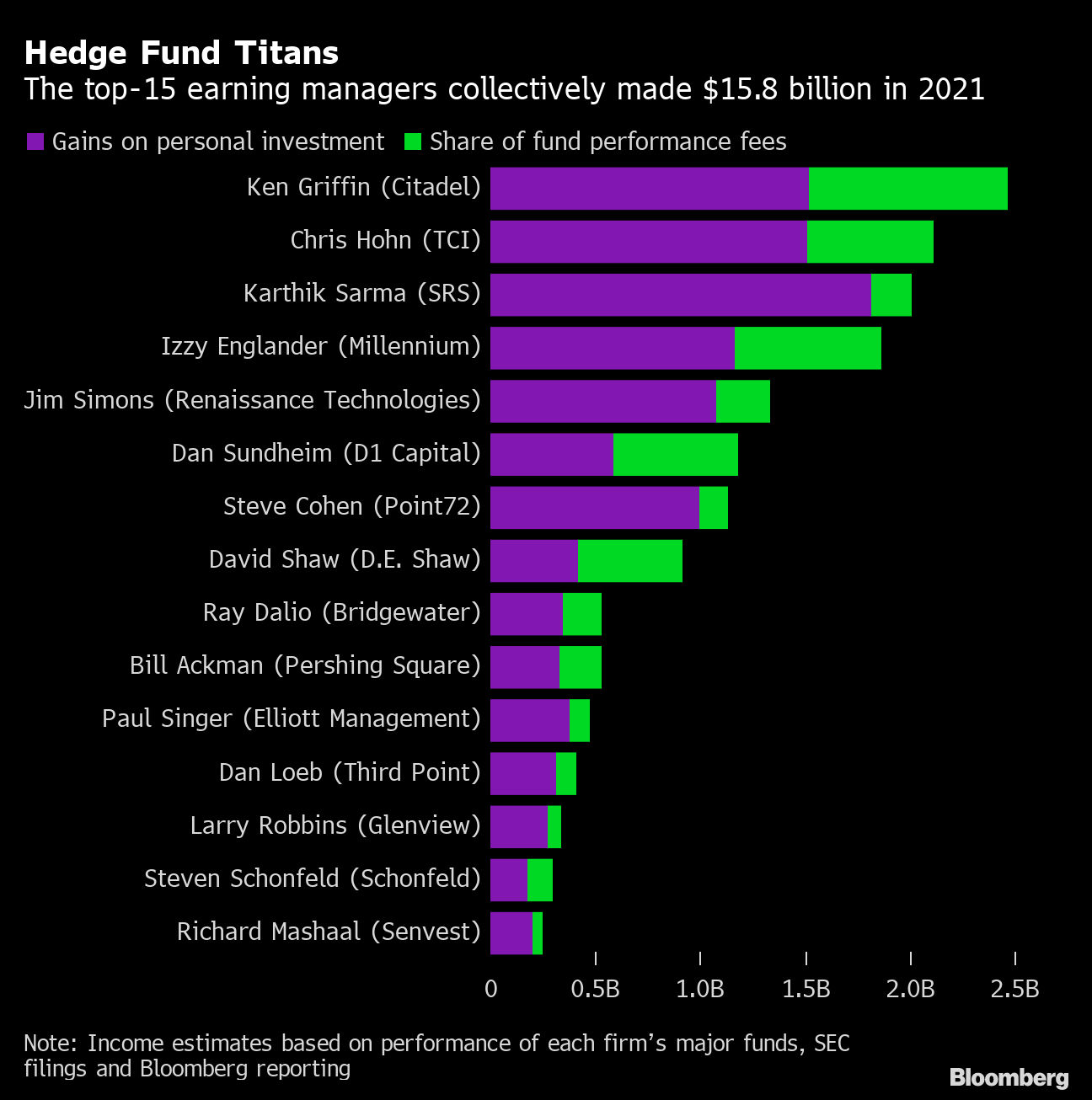

How to be hedge fund manager. Most successful hedge fund managers. Hedge fund managers make a name for themselves by being consistently right about the performance of investment products in various markets. As an investor, one can make a profit whether the financial markets go up or down, and hedge fund managers are masters at doing this.

How to become a hedge fund manager. Here is a snapshot of the pathway to the career: Money management related careers and degrees.

In this article, we explain what a hedge fund and hedge fund manager are, and what these professionals do, including details about their salary, key skills, work environment, how to become one and key strategies, along with an example job description. If you want to start a hedge fund, think of it like any other business startup: A hedge fund manager decides how pooled funds should be invested in order to meet certain objectives.

Hedge funds are an investment vehicle you may consider as an alternative to individual stocks or mutual funds. You should ideally be an investment banking analyst at a top bank, an equity research associate at a top bank, a research or investment analyst at an asset management firm or mutual fund, or a sales & trading professional on a highly. To become a hedge fund manager, a person needs a minimum of a bachelor’s degree.

What is a hedge fund? The directive adopted today amends the alternative investment fund managers directive, which governs managers of hedge funds, private equity funds, private debt funds, real estate funds and other alternative. Do some research online and identify resources relating to hedge fund management and investment.

What’s the difference between a hedge fund and a mutual fund? To be successful, a hedge fund manager must consider how to create and maintain a competitive advantage, a clearly defined investment strategy, adequate capitalization, a marketing and sales. Today, the council adopted new rules to improve european capital markets and strengthen investor protection in the eu.

Rokos capital management, which manages about $16bn of assets, is up 8.8 per. What’s the best way to hedge, and how much should you allocate to that? We covered these points in the article on how to get a job at a hedge fund, but to summarize:

That may not be such a bad thing, though. How does a hedge fund manager work? A hedge fund manager is a financial adviser who oversees investment accounts, leverages advanced financial software and raises expenditure capital.

A hedge fund manager is an individual who makes investment decisions on behalf of their clients, called limited partners (“lps”), using aggressive and sophisticated investment strategies. Build it like a business. 8 steps to becoming a hedge fund manager.

Clearly define your investment strategy and get ready to communicate it. How to become a hedge fund manager. A hedge fund is a limited partnership of private investors whose money is managed by professional fund managers who use a wide.

:max_bytes(150000):strip_icc()/GettyImages-485205331-af3fb443ce91443192ab756c7167ed58.jpg)